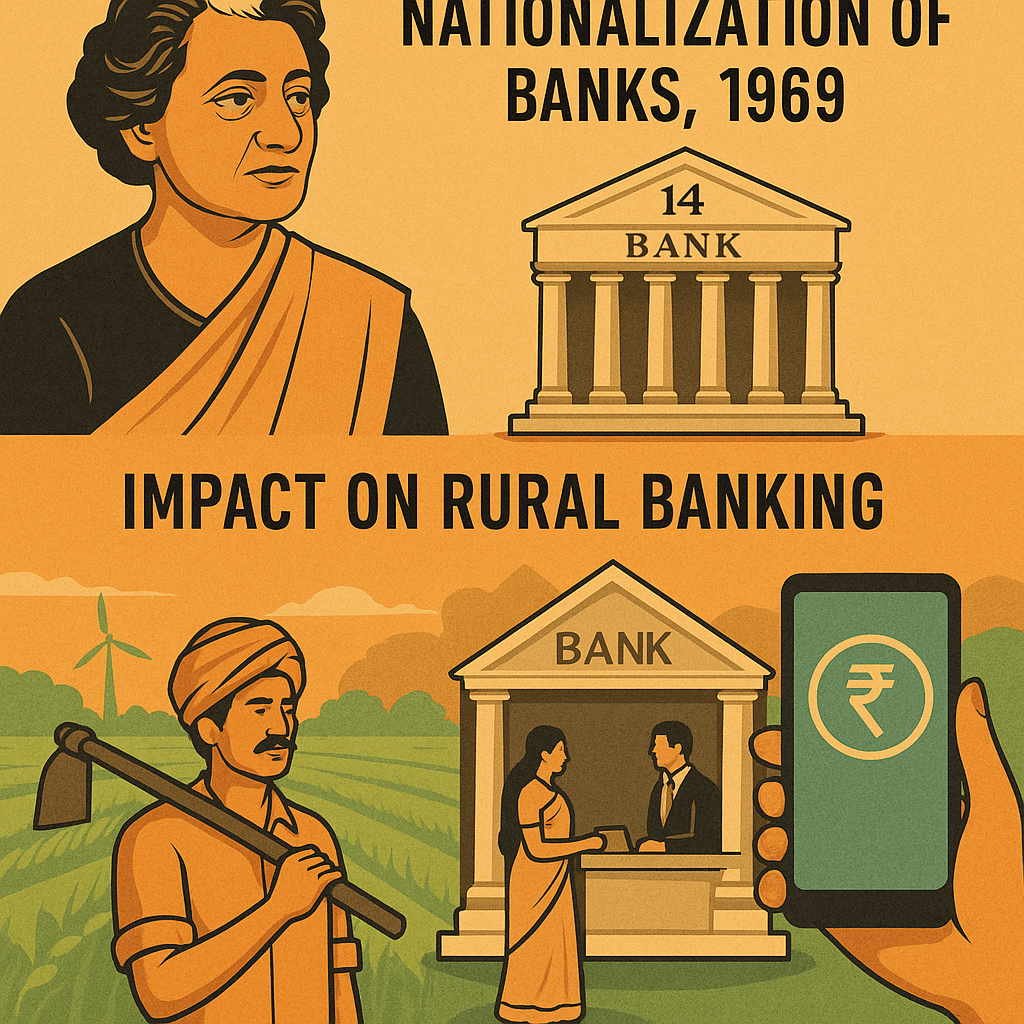

As of May 15, 2025, reflecting on India’s economic history, the 1969 nationalization of 14 major commercial banks by Smt. Indira Gandhi stands as a pivotal moment. Aimed at expanding banking access to rural areas and prioritizing sectors like agriculture, the policy was heralded as a step toward social equity. However, economists debate whether it also served as a mechanism for financial control over citizens. This article examines the policy’s impact on rural India, the need for subsequent initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY), and the governance challenges faced by Company Secretaries in government-owned entities navigating similar state-driven mandates.

Objectives and Impact on Rural India

The 1969 bank nationalization sought to democratize finance in a country where banking was largely urban-centric. In 1969, only 17% of bank branches were in rural areas, but by 1980, this number surged to over 15,000. The share of rural deposits grew from 3% in 1969 to 15% by 1985, and agricultural credit rose from 2% to 10% of total advances by 1975, per RBI data. This empowered rural farmers by reducing reliance on exploitative moneylenders and supported the Green Revolution’s agricultural boom.

However, the policy had significant flaws. Many rural branches were unprofitable, leading to inefficiencies. Political interference skewed loan disbursal, often favoring politically connected individuals over the deserving. A lack of financial literacy left many accounts dormant, limiting the policy’s transformative potential. While it laid the foundation for financial inclusion, its implementation fell short of fully integrating rural India into the formal banking system.

Economists’ Perspectives: A Tool for Financial Control?

1. State Dominance Over Economic Activity

Nobel laureate Amartya Sen, in Development as Freedom (1999), emphasizes economic freedom as a pillar of development. He argues that excessive state control over financial systems can curtail individual agency. While acknowledging nationalization’s intent to promote inclusion, Sen cautions that it enabled the state to influence citizens’ economic choices, such as directing credit to favored sectors or individuals. Historical records from the 1970s reveal instances where loans were disbursed based on political affiliations, indicating a form of financial control.

2. Political Patronage and Bureaucratic Overreach

Economist Jagdish Bhagwati, in India: Economic Reform and Growth (1993), critiques nationalization as part of the “license-permit raj.” He argues that it turned banks into tools of political patronage, allowing the government to control access to financial resources. In rural India, farmers often faced bureaucratic hurdles or needed political connections to secure loans, limiting their economic opportunities. Bhagwati contends this was not just about inclusion but about consolidating state power over citizens’ financial lives.

3. Surveillance and Monetary Policy

Former RBI Governor Raghuram Rajan, in The Third Pillar (2019), highlights how state-controlled banking systems enable financial surveillance. Nationalization gave the government unprecedented insight into citizens’ transactions. During the 1975–77 Emergency, the state used banks to freeze accounts of political opponents, a clear instance of financial control. By 2025, with digital banking and KYC norms, this surveillance has expanded, raising concerns about privacy and financial autonomy.

4. Counterview: Focus on Financial Inclusion

Economist Kaushik Basu, in a 2016 lecture, argues that nationalization’s primary goal was financial inclusion, not control. He credits the policy for bringing banking to rural India, reducing dependence on informal credit. The growth in rural deposits and agricultural lending supports this view, suggesting that political interference was an implementation failure rather than the policy’s intent.

5. Mixed Outcomes

Arvind Panagariya, in India: The Emerging Giant (2008), offers a balanced perspective. He acknowledges that nationalization empowered rural India but also created opportunities for state control. The Emergency and later events like demonetization in 2016, where public banks were instrumental in enforcing government policy, demonstrate how nationalization provided a mechanism for financial oversight, often at the expense of citizens’ autonomy.

The Need for Jan Dhan Yojana

If nationalization was so impactful, why did the Modi government launch the Pradhan Mantri Jan Dhan Yojana (PMJDY) in 2014? Despite the growth in rural banking post-1969, the 2011 Census revealed that only 54.4% of rural households had banking access. Many accounts remained dormant due to limited financial literacy and accessibility. PMJDY addressed these gaps by leveraging digital technology, opening over 53 crore accounts by 2025, with 67% in rural/semi-urban areas and deposits exceeding ₹2.3 lakh crore. Features like zero-balance accounts, RuPay cards, and overdraft facilities, combined with financial literacy campaigns, ensured greater usage, with over 80% of accounts active—a marked improvement over the nationalization era.

Governance Challenges: The Role of a Company Secretary

Similar to the dynamics of nationalization, government-owned companies often operate at the intersection of state control and public welfare. A Company Secretary in a 100% government-owned CPSE involved in land monetization faces unique challenges. They are responsible for ensuring corporate governance, legal compliance, and stakeholder coordination while navigating government mandates, such as those seen in asset monetization policies. For instance, the National Land Monetization Corporation (NLMC) can only acquire assets from CPSEs under strategic disinvestment at book value, as noted in prior correspondence. This limits flexibility, and political interference—akin to that seen in nationalized banks—can complicate compliance. A Company Secretary must balance transparency, manage board dynamics, and ensure financial accountability, often under bureaucratic pressure, mirroring the governance challenges of the nationalization era.

Conclusion

The 1969 bank nationalization was a landmark policy that expanded financial access in rural India, but it also served as a tool for state control, as debated by economists. While it empowered many, political interference and surveillance potential highlighted its dual nature. PMJDY built on this foundation, using modern technology to deepen inclusion. Yet, the legacy of nationalization persists in 2025, with public sector banks dominating the financial sector, raising ongoing questions about financial freedom versus state oversight. For Company Secretaries in government entities, these tensions underscore the need for robust governance to balance state objectives with public welfare, ensuring that policies serve citizens without compromising their autonomy.

Leave a comment